About the App

TBC UZ is a mobile banking app where individuals can apply for a loan online, make payments and card-to-card transfers, order a physical or virtual card, and open an online deposit. The app already has over 6 million users.

Challenges

- High competition from local banks and microfinance institutions.

- Strict regulatory requirements, including rigorous user verification, mandatory disclosure of the full cost of credit, and compliance with personal data protection standards.

- Low financial literacy among the population. Most of the target audience doesn’t understand the basic principles of lending, including interest rate calculation, fees, and overpayment risks.

- Distrust of digital products. A significant number of potential clients are reluctant to apply for loans via mobile apps due to fear of being deceived.

- Need for multilingual communication. Effective advertising campaigns require adaptation into Uzbek, Russian, and local dialects.

- Advertising platform restrictions. Google Ads often rejects ads containing words like “loan,” “credit,” or “interest rate” due to anti-fraud policies.

- Cultural barriers. In Uzbekistan, loans are often perceived as undesirable or even shameful, leading to low CTR and high drop-off rates after clicking on ads.

- Limited Post Click Cookie duration. Only 7 days from app installation to loan issuance, which requires targeting audiences with a high likelihood of conversion.

Solution

Target Audience Analysis.

- Age: 22–45 years (urban residents, self-employed, small business owners).

- Income: average and below average.

- Needs: loans for major purchases (appliances, home renovation, education), fast approval without documentation, transparent terms, and no hidden fees.

Testing and Optimization.

We tested several targeting options in Meta Ads:

- Broad audience. Ages 22–60, Uzbekistan.

- Lookalike audience. Based on users who have already received loans.

- Interest-based audience.

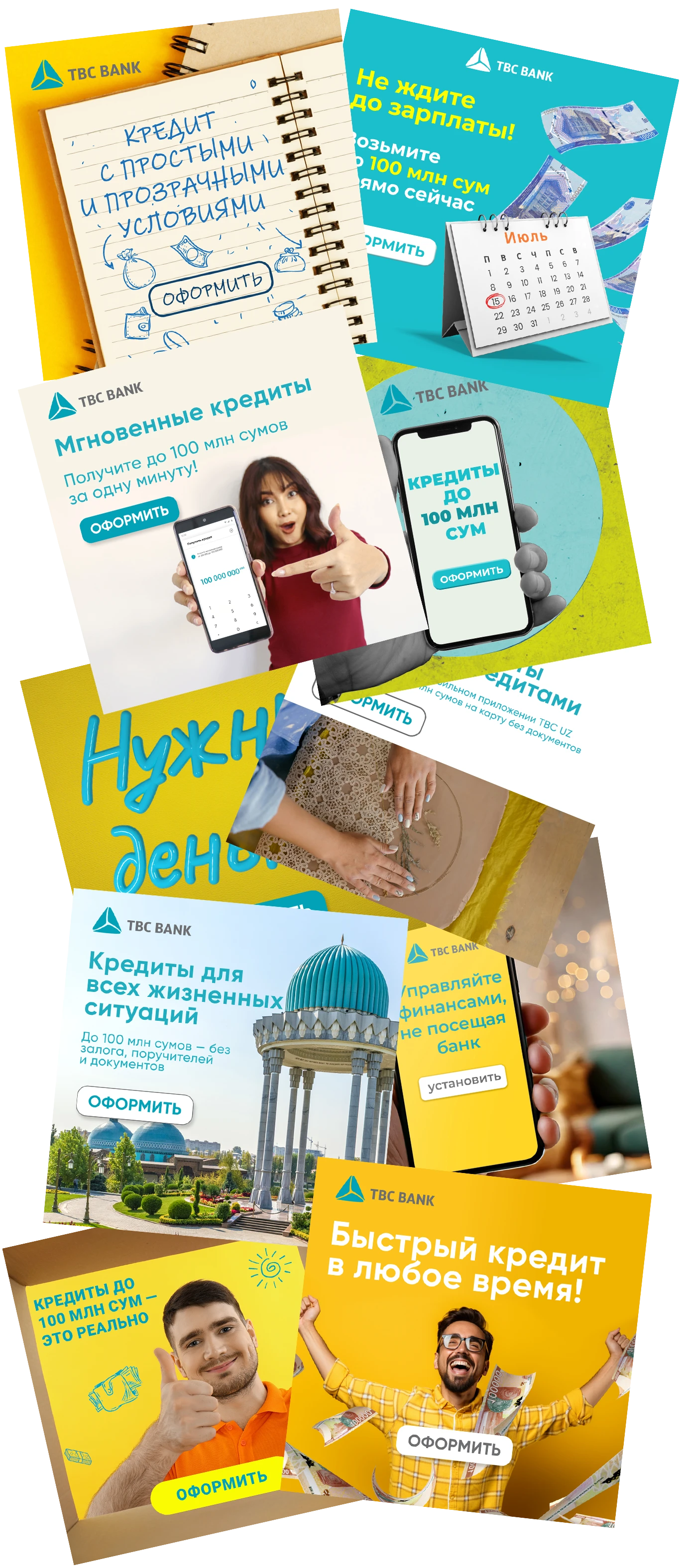

- Various creative concepts featuring people/app screens, clearly stating the loan terms, showing examples of completed applications, messages about loan approval, and illustrations of purchases (e.g., loans for buying electronics before the start of the school year).

Google Ads. Our team tested videos of various lengths (7–15 seconds, 16–20 seconds, 21–30 seconds, and over 30 seconds) to cover as many placements as possible. As a result, we tested top-performing videos across different time frames and 3 formats (horizontal, vertical, and square).

Xiaomi Global. We used the push notification format, created a blacklist of placements, and launched a remarketing campaign to re-engage users who installed the app but did not submit an application. In the end, the team tested various networks to attract higher-converting traffic.

Content Localization.

The content was translated into Uzbek by a native speaker.

Results

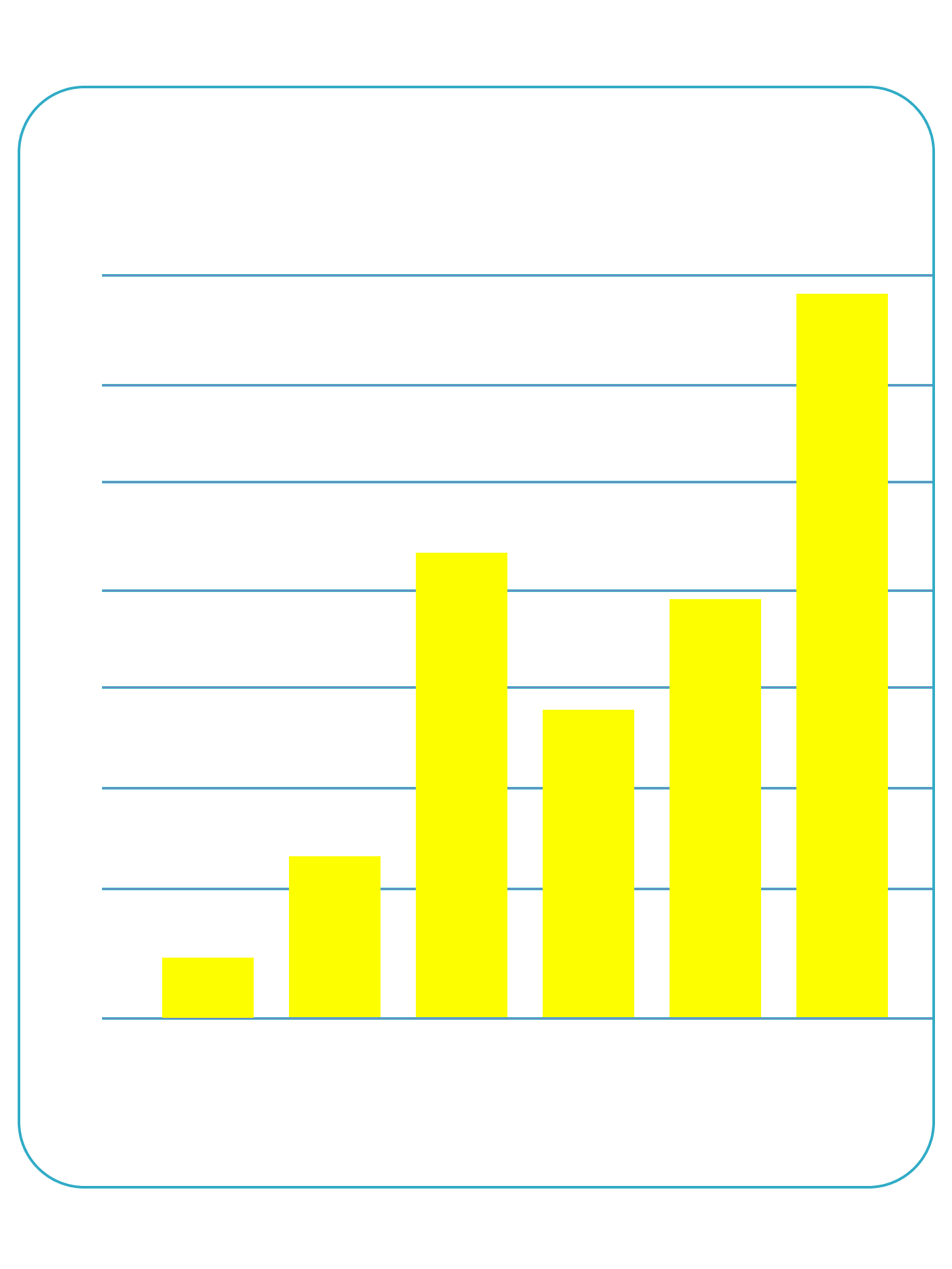

During the 6 months of the Acquisition.mobi and TBC Bank partnership, our client has achieved the following results:

- The total number of unique loans issued reached approximately 10000.

- Significant growth in applications and issued loans. 80% of conversions come from in-app networks, including Xiaomi Global. Conversion rate from application to approved loan increased by 70%.

- From July 2024 to December 2024, the number of loans issued grew 12-fold.

- The average number of loans issued per month was approximately 1700.