About the App

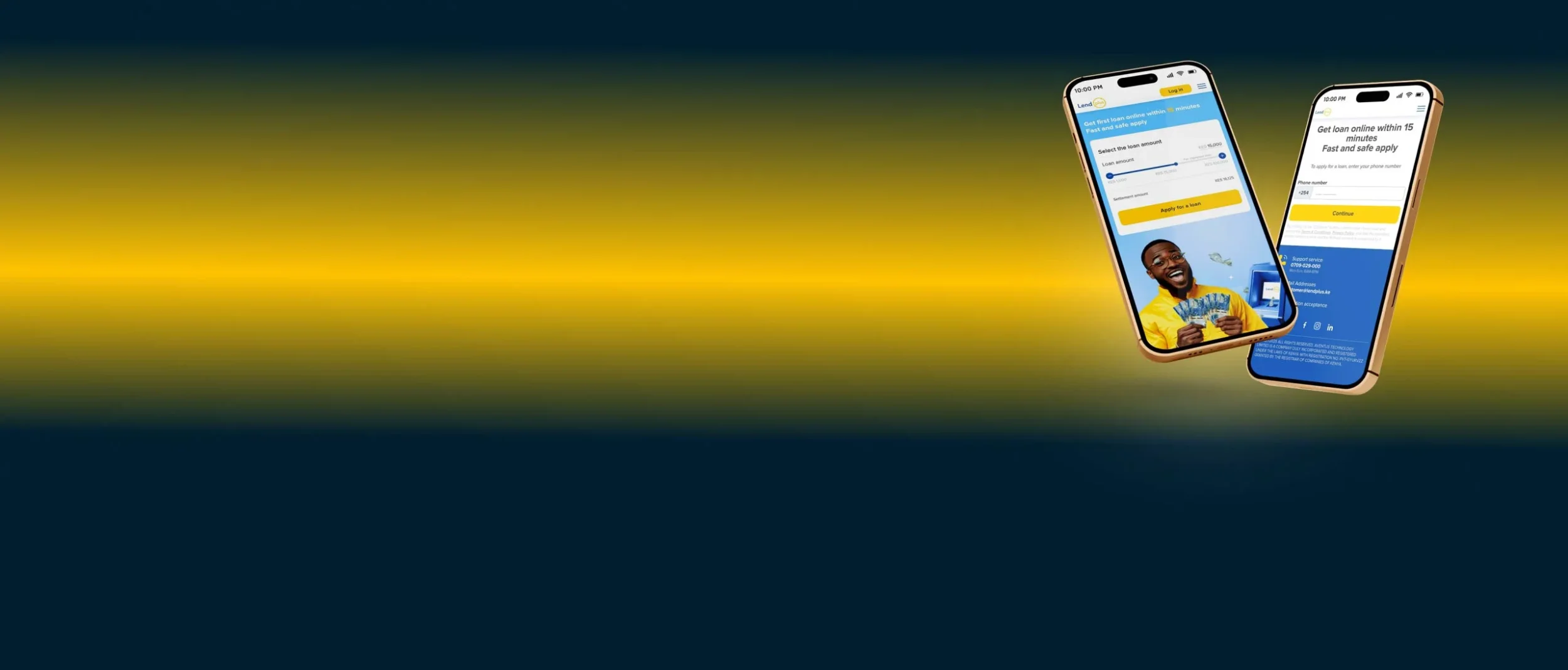

LendPlus is a micro-lending mobile app in Kenya that provides fast loans.

Challenges

- Advertising policy restrictions. Facebook and Google regularly reject creatives and ad texts related to loans and microcredit.

- High competition. Competing applications are heavily promoted and offer similar functionality.

- User concerns about online loans due to the presence of fraudulent services.

Solution

Promotion Channels

Facebook (Meta Ads)

- Promotion through targeted advertising based on interests (finance, microloans, small business).

- Use of Lookalike Audiences to find new customers similar to existing users who have taken a loan.

- Use of a broad audience aged 18–57.

Google (Google Ads)

The campaign focused on mobile app installs via Google Play.

Ad Formats Development & Optimization

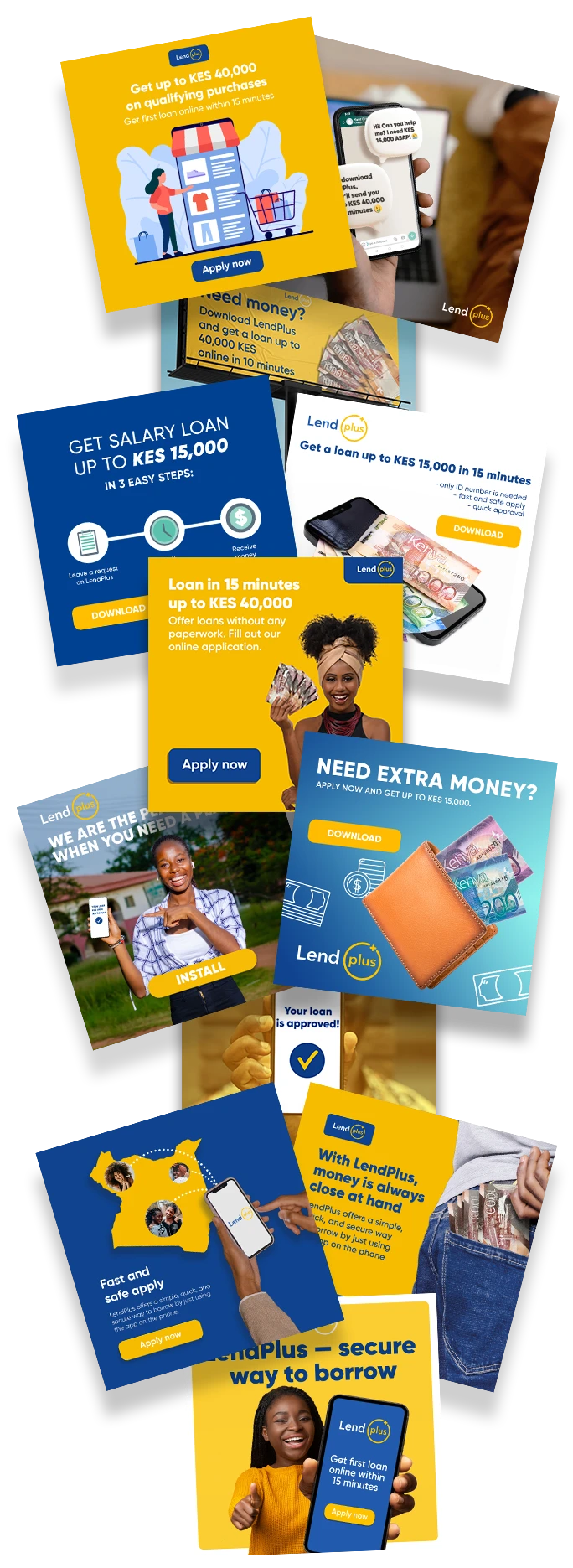

Our team implemented a diverse range of advertising formats to engage our target audience effectively:

- Video Ads. Demonstrated the simplicity of the loan application process, showcased step-by-step form completion, and highlighted sample messages received throughout the customer journey.

- Banners. Communicated key loan terms, featured customer testimonials, presented profiles of approved applicants, and illustrated product examples that can be purchased using the loan amount.

- Google Ads. Different lengths videos to cover as many placements as possible. We tested high-performing videos in multiple timeframes and formats to identify the most effective combinations.

Localization

- Our team utilized UGC videos featuring locals to build trust.

- All banners and videos displayed amounts in the local currency for greater relevance.

- We continuously improved ad copy and creatives, carefully refining language—avoiding explicit use of terms “cash” or “loan” in headlines—to comply with platform policies.

- Also, we highlighted LendPlus’s unique value propositions: higher initial loan limits and flexible repayment extension options.

- Additionally, we included messages about the company’s licensing and secure data processing to reinforce credibility and trust.

Results

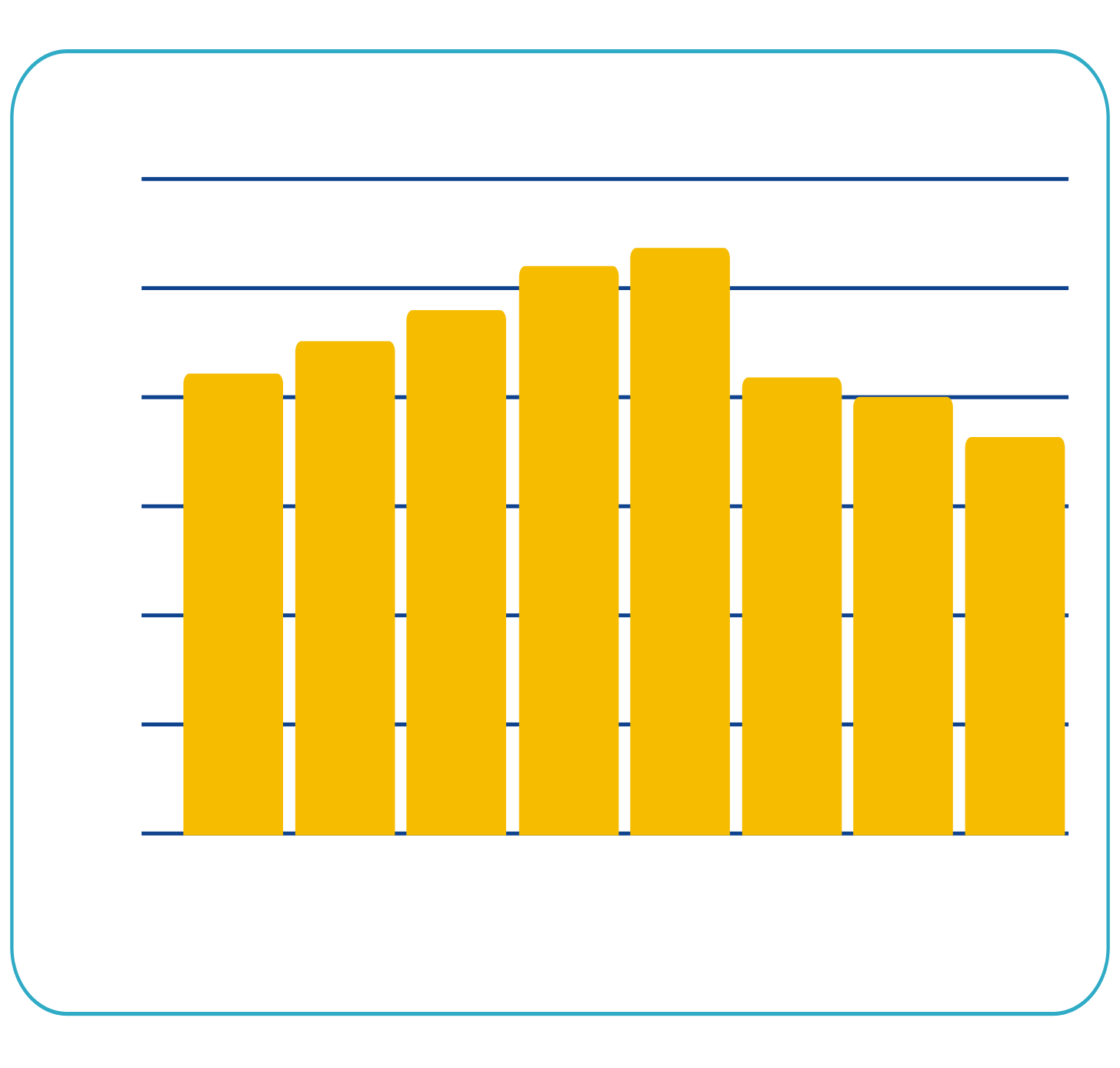

Over the course of the 8-month advertising campaign, we achieved the following results:

- A total of 35,715 unique loans were issued.

- The conversion rate from application to loan approval reached 23%, while the conversion rate from app install to application submission was 40%.

The decrease in loan volume starting in December reflects the impact of temporarily pausing Meta advertising during the app suspension period.